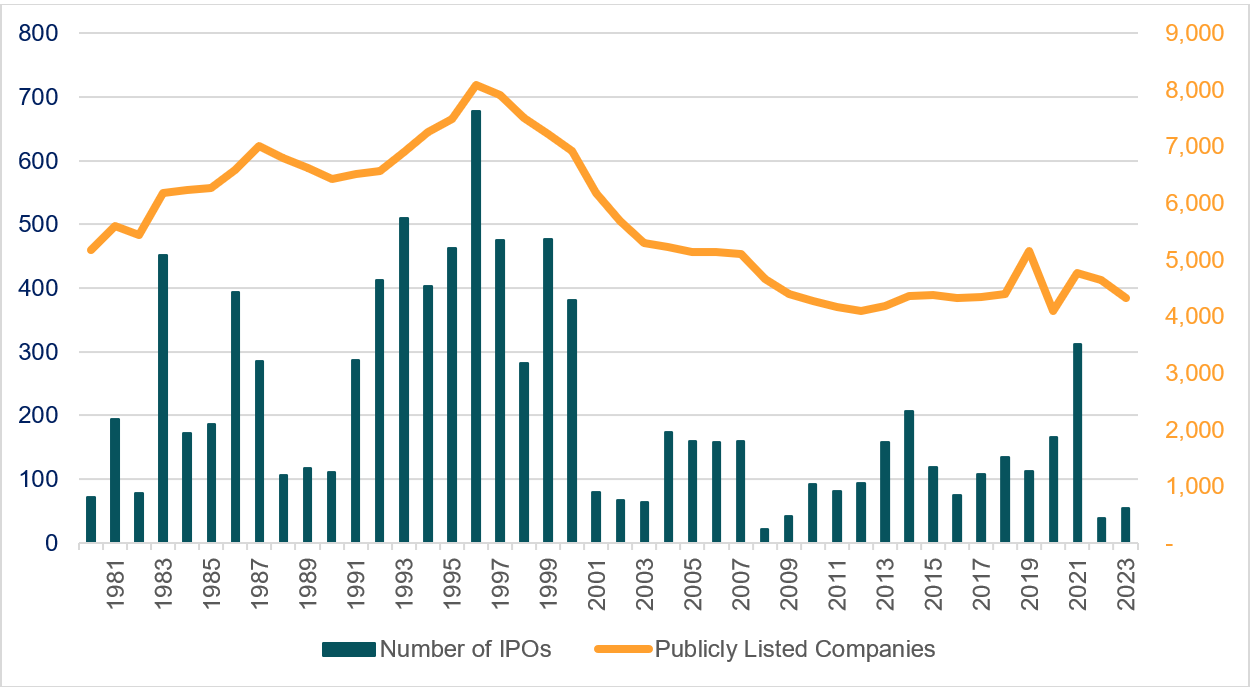

Nov. 14, 2024 – Over the past 25+ years, the number of publicly listed companies on U.S. stock exchanges has fallen sharply. Consider that in the late 1990s, there were more than 8,000 listed companies in the U.S. By 2008, there were less than 5,000. As of 2023, there were approximately 4,317 listed companies.1

Some decline comes from delistings — i.e., public companies that either go out of business or merge with another firm. Private equity firms also acquired some public companies in the period of depressed valuations during the 2022 bear market.2 However, one of the biggest declines is due to reduced IPOs (Initial Public Offerings). In the late 1990s, there were nearly 400 IPOs on average. Fast forward to 2023, there were 54.3 Moreover, many tend to be small deals that don’t raise significant capital. Only ten companies raised $100 million or more in IPO proceeds in the first six months of 2023, compared to 517 such transactions in the same period of 2021.4

IPO Companies vs. Publicly Listed Companies

In 1996, the number of public companies peaked at more than 8,000. Today, there are approximately 47% less.

Source: “Listed Domestic Companies, Total,” World Federation of Exchanges, 2023. Jay Ritter, “Initial Public Offerings: Updated Statistics,” University of Florida, 2023.

It’s helpful for your clients to understand why this trend is occurring, how it might affect their portfolios, and whether they should consider adjusting their investment strategy.

Several Factors Behind the Trend

There are several reasons why companies are staying private longer. One is that there are significant high costs, including legal, accounting and tax, to publicly list a company. In addition, the underwriting fees paid to bankers who shepherd a company through the IPO process range from 4% to 7% of the gross proceeds raised.5 There’s also a requirement for management to file financial statements and other disclosures as per the SEC rules and meet with institutional investors. That burden is particularly heavy on early-stage companies, which may not have the organizational resources or hard dollars to do it all. Additionally, the time and dollars spent to list and maintain a publicly traded company may take away resources from other important functions, such as R&D or company infrastructure.

Being publicly traded also exposes companies to daily market volatility. Publicly traded companies need to meet quarterly earnings targets and shareholder expectations, and market sentiment can often be driven by emotions and short-term thinking rather than a company’s long-term performance. Finally, some companies can access capital from other sources, meaning they don’t need to sell equity to the public to fund their continued growth.

Why It Matters

The decline in publicly traded companies may have a real impact on your clients. Why? First, when companies wait longer to go public, they may already be past some of their highest-growth years. Meanwhile, investors who have access to private companies, while this can be riskier and illiquid, could have an advantage since some of these companies may still be in their peak growth years. The second is that when the number of publicly traded companies has been dramatically reduced, there are limited business investments available to diversify portfolios.

For additional diversification, many investors may need to look wider to gain exposure to the broader U.S. economy through private markets. This could mean considering a wider set of investments, including alternatives such as private capital. Publicly traded stocks still have a role in many investors’ portfolios but shouldn’t be the sole focus.

1 “Listed Domestic Companies, Total,” World Federation of Exchanges, 2023.

2 Alexandra Semenova, “Private equity buying up public companies at a record pace during bear market washout,” Yahoo! Finance, Aug. 2, 2022.

3 Jay Ritter, “Initial Public Offerings: Updated Statistics,” University of Florida, 2023.

4 Ari Levy, “Tech IPO drought reaches 18 months despite Nasdaq’s sharp rebound in the first half of 2023,” cnbc.com, June 29, 2023.

5 “Considering an IPO? First, understand the costs,” PwC, 2023.

Represents CNL’s view of the current market environment as of the date appearing in this material only. There can be no assurance that any CNL investment will achieve its objectives or avoid substantial losses. Diversification does not guarantee a profit nor protect against losses.

CSC-1024-3935494-INV