The Benefits of Private Capital for Businesses and Investors

Some aspects of traditional private equity have a negative connotation. A unique strategy, called private capital, can create value for both companies and individual investors.

Nov. 13, 2024 – Many people hear the words “private equity” and picture distressed companies in need of a turnaround. Or they may think of early-stage venture capital firms willing to absorb losses in hopes of funding a startup that becomes the next Amazon. In reality, there are many different types of private equity strategies including a differentiated strategy known as private capital. Defined as the ownership of both the debt and equity of established, growing private companies, private capital may offer potential benefits for both the companies and the investors that put up the capital to fund those investments.

Let’s start with the potential benefits for portfolio companies. Many of these tend to be high-quality, profitable companies with a strong growth trajectory and solid management teams, yet they still may need some additional support to get to the next level. Because the company’s executives have been focused on growing its business, it may not have the resources, expertise, or relationships to capitalize on the full range of options available.

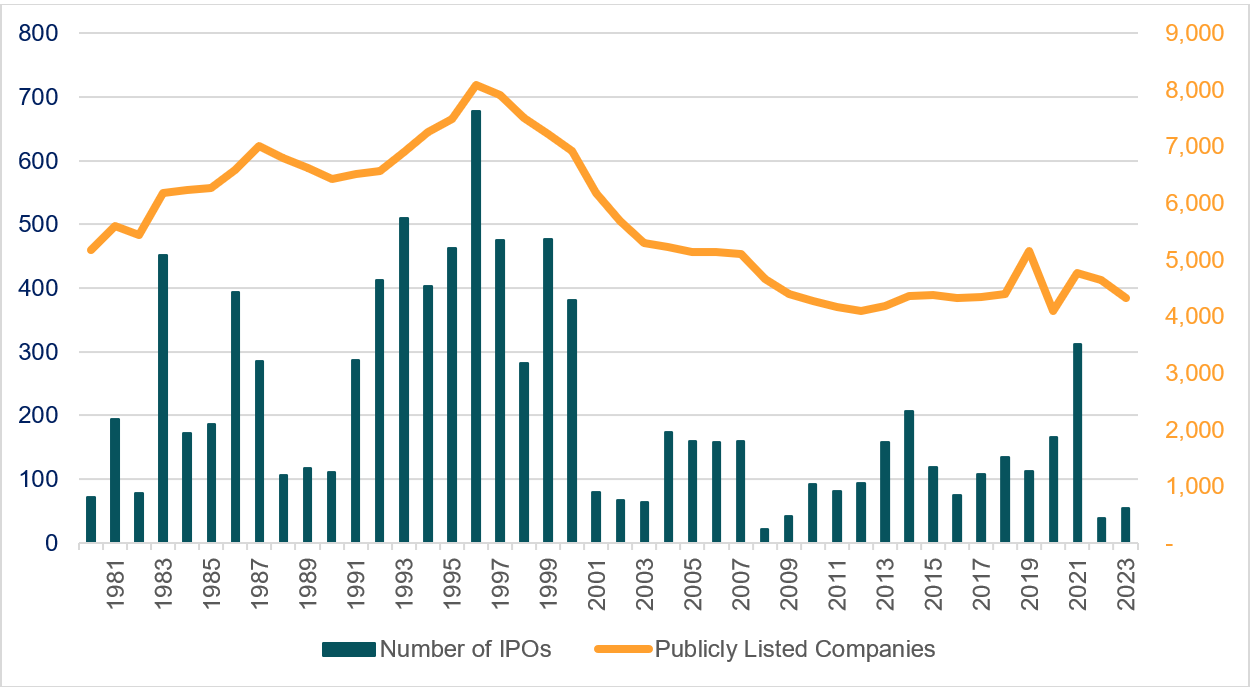

In the past, some of these companies may have gone public (IPOs) to access capital, but that avenue is less attractive for many mid-sized organizations. IPOs bring a high compliance burden and require frequent financial disclosures. Over the past 30 years, the number of public companies has declined, and the number of IPOs has decreased (see previous blog post).1 Similarly, bank lending has become more constrained, further limiting access to growth capital.2

IPO Companies Vs. Publicly Listed Companies

In 1996, the number of public companies peaked at more than 8,000. Today, there are approximately 47% less.

SOURCE: “Listed Domestic Companies, Total,” World Federation of Exchanges, 2023. Jay Ritter, “Initial Public Offerings: Updated Statistics,” University of Florida, 2023.

That combination is creating a financing gap, which private capital firms are filling. These firms do not provide just capital — they also offer strategic and technical expertise to help make fast-growing firms more successful. Rather than extracting value from these businesses, they partner with a goal to create value, using several potential tools.

Ways to Create Value – Organic and Inorganic Growth

One potential means of value creation is organic growth. Organic growth is growth that is achieved through internal resources and capabilities. Private capital partners can bring a fresh look to a company’s business units and portfolio of products and services and ask whether there are ways to increase revenue by expanding or improving existing product lines, moving into new geographic markets or sales channels, or developing new products and services.

Pricing is another means of organic growth. Many organizations do not look strategically at the prices they charge, instead relying on “what we charged last year.” A common tool that private capital firms will apply is optimizing pricing, by determining how to increase prices without affecting demand.

Operational improvements to portfolio companies are another example of organic growth. Because these firms tend to have wide-ranging experience in an industry, they can bring best practices to the companies they acquire. This is particularly relevant in terms of integrating technology into the business, streamlining operations to reduce waste or implementation of lean manufacturing.

A second means of possible value creation is inorganic growth through M&A (merger and acquisition) deals. Firms can create value by making strategic acquisitions — typically of smaller, complementary businesses that they can tuck into the parent company—and generate some cost savings or synergies between both businesses. Smaller deals often have lower multiples, and firms can bundle together several companies in a similar industry to generate scale advantages. Inorganic growth may also give organizations rapid access to fast-growing products, markets, or customer bases — often significantly faster than a company could achieve through organic growth.

Partnering with Management

Another unique aspect of private capital is that it aligns the interests of key stakeholders. Firms typically take a majority stake but retain the existing management team, often with attractive incentive plans that give that team “skin in the game.” In other words, the existing management teams of the acquired businesses may have meaningful ownership alongside the investment managers. For that reason, the company’s minority owners retain the right mindset to roll up their sleeves and continue to grow the business.

Potential Benefits for Investors

As stated earlier, private capital is different than traditional private equity because it typically combines equity ownership alongside a debt investment in the same private business. The combined aspects of both income and capital appreciation create a total-return investment. The debt securities can provide income from interest payments on the debt investment. (Traditional private equity includes no debt investment, so investors don’t see any returns from those holdings until the portfolio companies are sold and the fund is liquidated.) Growth can come through the equity ownership if the business value increases. Ideally, the company will be worth more over time due to improvements to the business, which may generate higher returns for investors.

Because the strategy is the acquisition of private companies, private capital may offer investors diversification in assets that do not move in tandem with the publicly traded markets. Last, private capital gives individual investors access to private companies that had previously been limited to institutional investors.

Private capital has limited liquidity, is not suitable for all investors, and entails higher risk than traditional investments. As a result, you will need to work with clients to determine whether it is a fit for their portfolio and long-term financial goals. But for those who want to invest to help grow durable companies, private capital may offer diversification.

1 “Listed Domestic Companies, Total,” World Federation of Exchanges, 2023.

2 Vasco Curdia, “Economic Effects of Tighter Lending by Banks,” Federal Reserve Bank of San Francisco, May 24, 2024.

Represents CNL’s view of the current market environment as of the date appearing in this material only. There can be no assurance that any CNL investment will achieve its objectives or avoid substantial losses. Diversification does not guarantee a profit nor protect against losses.

CSC-1124-3552135-INV