July 29, 2021 – Traditional private equity investments are not open to individual investors. Private equity has generated higher returns than some other asset classes over the past 10 years, but it also has higher costs and risks.1 Primarily because of this, participation is often limited to investors with $5 million or more in assets. Another challenge is that private equity investments require significant capital up front and take time before they are expected to generate any returns, a phenomenon called the “J-curve effect.” A unique strategy known as private capital (owning both debt and a controlling equity position in the same private business) could potentially generate some of the benefits of private equity in a way that’s more accessible to individual investors, and it may limit some of these negative aspects.

Understanding the J-Curve Effect

It sounds like the name of a spy thriller, but the J-curve effect is a phenomenon that happens during the early years of an investment in traditional private equity. During the investment period, fees are charged and returns can be slow to come in, because of the way these investments are structured. When a private equity fund launches, investors commit a certain amount of money, which gets drawn down as investment opportunities are identified. That process may take up to three to five years, but investors typically pay management fees on the full amount of capital they committed, starting on day one.

For example, if an investor commits $100,000 to a fund that charges a 2% annual management fee, the investor will pay that fee on the full $100,000 in the first year. That’s true even if the fund only invests a portion of the amount in the first year. To further illustrate this hypothetical example, let’s assume that only $20,000 is invested in the first year, the investor would pay $2,000, effectively resulting in a 10% management fee on invested capital that first year.2

Another factor is that if a private equity fund invests in distressed businesses—the kind that require a turnaround—it would generally lead to even higher upfront costs. And in some cases, funds boost their initial investments in businesses by borrowing money from third parties. If the investments begin to pay off, that senior debt typically gets paid off first, before equity investors begin to see returns.3

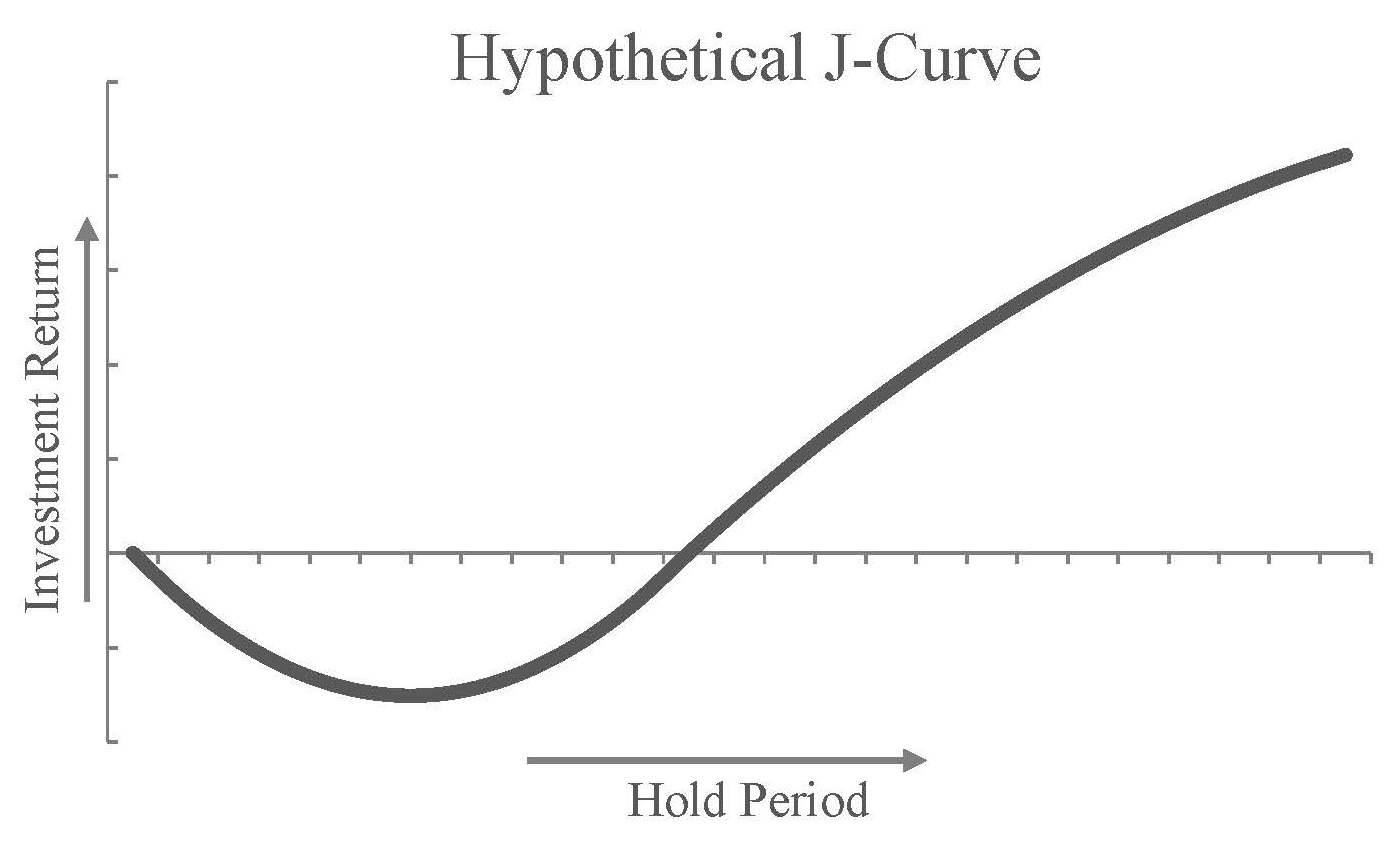

These factors can lead to a net outflow of cash during the early years of a typical private equity investment. When returns are plotted on a graph (see exhibit), it looks like the letter “J.” (Some in the industry refer to this as the “valley of tears.”)4

Due to the speculative nature of private equity, some investments may never generate a positive return.

Three Ways to Smooth the Curve

However, there are three ways to smooth out the J-curve, potentially reducing and/or shortening this period for investors:

- Invest in a company that charges fees on invested capital, rather than committed capital.

- Invest in a company that seeks to acquire durable and growing businesses, rather than those in distress.

- Invest through a combination of private equity and debt (also known as private capital) with the goal of generating both income and growth.

The first such strategy is to invest in a company that is established and charges fees when capital is invested. In this way, an investor’s capital is not charged management fees until it is put to work.

The second strategy for smoothing the J-curve is to avoid acquiring businesses that need turnarounds. These can be strong performers over the long haul, but they carry higher risk and often need repeated infusions of working capital early on, meaning a longer period of negative cash flow for investors before the investment may generate a return. Instead, invest in a company that focuses primarily on strong, healthy businesses that need capital in order to grow (rather than recover).

Third, invest in a strategy that often owns both the controlling equity positions alongside debt positions (also referred to here as private capital), rather than equity alone. The addition of private debt is appealing as the interest payments may generate income. When distributed, that income can further flatten the J-curve.

To be clear, private capital is a complex investment strategy, and it is not right for everyone. It requires that suitability standards be met, and it requires a long-term time horizon and a greater tolerance for risks and fees compared to traditional investments. That said, a private capital investment may help investors access some of the upside using a private equity strategy while potentially reducing some of the drawbacks, including the J-curve.

CNL Strategic Capital

Please read the prospectus, including the full Risk Factors section for offering details.

An investment in CNL Strategic Capital, LLC is considered speculative and involves a high degree of risk, including the loss of all or a substantial amount of investment. CNL Strategic Capital is not private equity and is not a short-term investment and requires investors to meet the minimum suitability standards.

This is not an offer to sell nor a solicitation of an offer to buy shares of CNL Strategic Capital. Only the prospectus makes such an offer. This piece must be read in conjunction with the prospectus in order to understand fully all the objectives, risks, charges and expenses associated with an investment and must not be relied upon to make a decision.

CNL Strategic Capital is a recently formed entity that has limited operating history. It may be unable to successfully implement its business and acquisition strategies or meet its investment objectives. Investors will not have the opportunity to evaluate businesses prior to acquisition.

If CNL Strategic Capital is unable to raise substantially more funds, it will be limited in the number of businesses it acquires, which reduces diversification and increases the potential for volatility.

An investment in CNL Strategic Capital is illiquid and no secondary market is expected to develop. Shares sold in this offering will not be listed on an exchange or quoted through a quotation system for the foreseeable future, if ever. Investors will have limited liquidity. If investors are able to sell their shares, they will likely receive less than their purchase price.

Distributions are not guaranteed in frequency or amount. Distributions will be paid from net investment income, offering proceeds, borrowings or reimbursable expense support, which will reduce future cash available for distributions and be dilutive to future shareholders.

1 Past performance of an asset class is no indication for future results of this investment strategy. The comparison stated represents select asset class indices or composites that are materially dissimilar to CNL Strategic Capital, which has higher fee structure and risk level, longer time horizon, and fewer liquidity options. Underlying data for each asset class may be reported and calculated using differing criteria, which has a material impact on returns and overall result. There are significant differences between public and private equities, which include but are not limited to, the fact that public equities have a lower barrier to entry than private equities and there is greater access to information about public companies. Private equities have a longer time horizon than public equities and are considered highly illiquid.

2 This illustration does not take into account any sales loads, upfront fees or fund level fees and expenses that the investor would bear.

3 “Understanding How the J Curve Works in PE and Economics,” Corporate Finance Institute, 2018, accessed March 26, 2018.

4 Gino D’Alessio, “Private Equity and the J-Curve,” Sophisticated Investor, Oct. 29, 2015.

Forward-looking statements are based on current expectations and may be identified by words such as believes, anticipates, expects, may, will, continues, could, targeted and terms of similar substance, and speak only as of the date made. Actual results could differ materially due to risks and uncertainties that are beyond the offering’s ability to control or accurately predict. Investors and financial advisors should not place undue reliance on any forward-looking statements.

CSC-0821-1716215-INV