July 19, 2023 – In a roaring bull market, investing can be straightforward. You can work with your clients and choose from a wide range of asset classes with reasonable confidence. But in the current market—with high interest rates, inflation, geopolitical uncertainty and sluggish economic growth—choosing where to invest feels more daunting. At times like this, it’s helpful to know what the other professionals think, not to mimic them directly—most retail investors simply can’t—but more so that they often have insights and expertise that may be worth considering.

In Natixis’s most recent institutional outlook survey, which drew responses from 500 institutional investors in 30 countries around the world, respondents point to some specific concerns.1Among them:

- 59% say that a recession is inevitable.

- 65% say that stagflation—low economic growth and high inflation—is a bigger potential challenge.

- 57% point to war as a top economic threat for 2023, followed by policy error (53%) and US-China tension (40%).

However, even more interesting is that institutional investors remain optimistic despite these concerns. Nearly eight in ten (77%) say they will maintain or increase their assumptions about average returns.

Why optimism? Despite the ominous signals, institutional investors also see some opportunities.

Private equity is promising, and bonds are back.

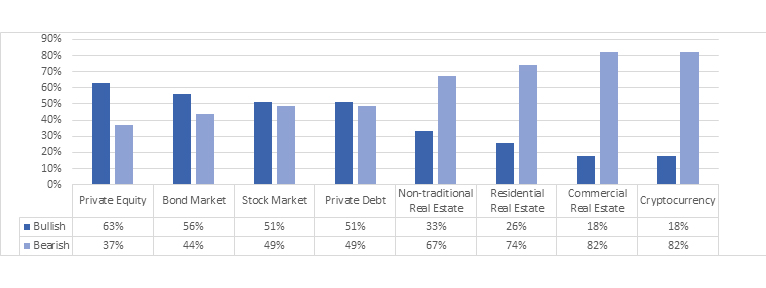

Among all asset classes, Natixis respondents were the most positive about private equity, with 63% bullish and 37% bearish. Similarly, investors’ views on bonds were more likely to be positive (56% versus 44%). Seventy-two percent of institutional investors believe that rates will usher in a resurgence in traditional fixed-income investments, partly because they see rate hikes continuing. Among insurers, which often have large bond holdings, nearly half are raising their return assumptions because of the tailwind for fixed-income investments. In contrast, investor sentiment was roughly split regarding private debt (51% bullish, 49% bearish) and decidedly negative about cryptocurrency (18% versus 82%).

Bull/Bear Outlook

SOURCE: 2023 Natixis Institutional Investor Outlook Survey: After the Gold Rush, Natixis, 2023.

Volatility in stocks will continue. Given the way that major stock indices have flatlined in the past several years—as of June 2023 the S&P 500 was essentially where it stood two years earlier2—investors may think stocks are poised to rebound. But institutional investors aren’t convinced. The overall outlook on equities is roughly split between bulls and bears. However, a majority of respondents to the Natixis survey believe that volatility will increase in 2023. To be clear, they are not pivoting away from stocks; they just don’t anticipate a big run-up.

Alternatives remain a key part of portfolios. Most institutional investors are making minor shifts in their portfolio strategy. Yet one area they are not changing is their allocation to alternatives—remaining level at 18%. Two-thirds of respondents think a portfolio with 60% equities, 20% bonds, and 20% alternatives will likely outperform the traditional 60/40 portfolio. Overall, 29% plan to increase their allocation to real estate (including REITs), 43% plan to increase their private equity and VC holdings, and 36% are focusing more on private debt. A key feature that makes alternatives attractive is their potential for income combined with their goal of portfolio risk mitigation.

Other research has reached similar conclusions. For example, a recent survey of institutional investors conducted by BlackRock Alternatives found that 72% plan to increase their allocation to private equity in 2023, and 52% say the same about private credit. Overall, respondents to the BlackRock survey allocate 24% to private markets, on average.3

A key advantage of alternatives in all markets is diversification, but that’s particularly true right now when many asset classes move up or down based on central bank decisions regarding rate hikes. With much of the investing world waiting for the next announcement from the Federal Reserve, it’s critical to have some assets that move independently, and alternatives can fill that role for some investors.4

To be clear, alternatives may not be a good fit for everyone. They pose liquidity challenges, some are limited to qualified or accredited investors, and they can entail more risk than traditional asset classes. But for some clients, they may be worth considering as part of a diversified portfolio.

2 S&P 500 from June 1, 2021 – June 1, 2023, Yahoo Finance! accessed June 15, 2023.

3 “BlackRock Alternatives: Institutional investors to increase private equity allocation,” Pensions & Investments, April 18, 2023.

4 “Opportunity in disguise: Why bad news may be good news for alternatives in 2023,” Wellington Management, December 2022.

Represents CNL’s view of the current market environment as of the date appearing in this material only. There can be no assurance that any CNL investment will achieve its objectives or avoid substantial losses. Diversification does not guarantee a profit nor protect against losses.

CSC-0723-2965206-INV-E