CNL surveyed financial professionals to find out their thoughts on non-traded alternatives. Here’s what they said.

July 31, 2024 – In April, CNL conducted its 2024 Alternatives Outlook survey against a unique backdrop. Financial professionals were navigating what looked like a higher-for-longer interest rate environment.1 The S&P 500 was hovering near its all-time high from the month prior.2 At the same time, non-traded alternative capital raise was experiencing a continued shift away from real estate investment trusts (REITs) and toward other assets and strategies.3

The survey’s findings uncovered that some attitudes—like the likelihood of recommending an alternative product—shifted along historical trend lines. Elsewhere, the results either identified unexpected changes in sentiment or gathered new information altogether. Highlights from the survey follow.

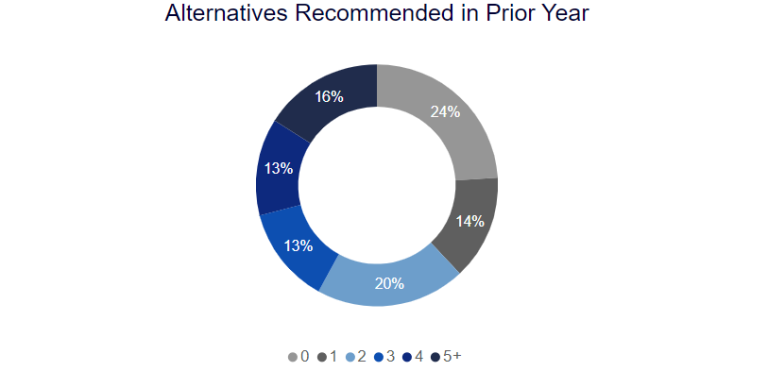

How Many Alternatives Products?

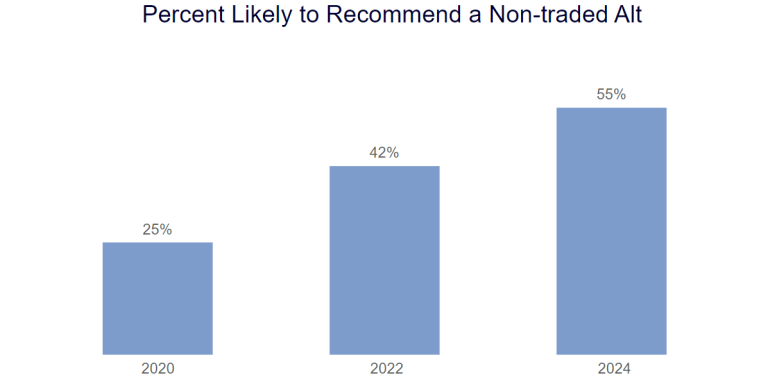

Future Recommendation Sentiment

Recommendation sentiment has trended upward in recent years. In the most recent survey, more than half of respondents said they were likely to recommend a non-traded alternative in the next 12 months.4 Only a quarter of respondents said the same thing back in June 2020.

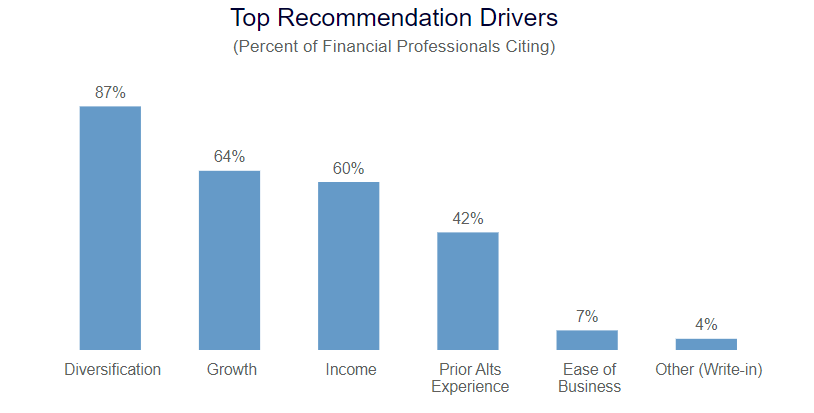

Top Recommendation Drivers

Survey respondents who said they were highly likely to recommend a non-traded alternative in the next 12 months were asked a follow-up question to explain their key decision drivers.5 Respondents could select all criteria that applied to them. The overwhelming majority cited diversification as a reason they plan to recommend alternatives. Other reasons garnering a critical mass of responses included opportunities for growth and income, and prior experience with non-traded alternatives. Additional write-in responses tended to reference potential tax benefits associated with certain types of alternatives.

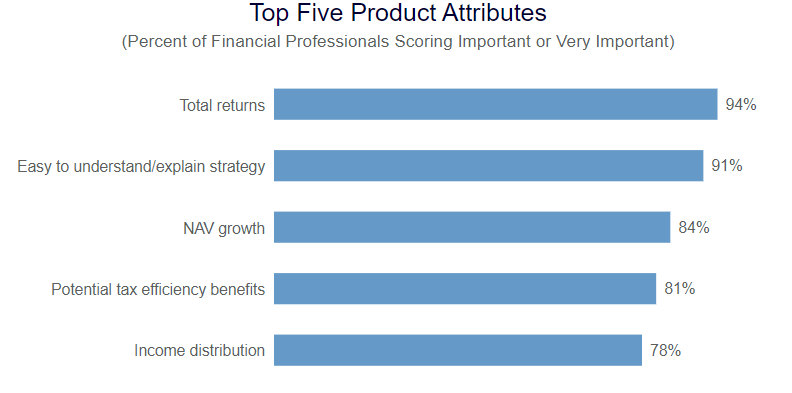

Top Five Product Attributes

What financial professionals said they wanted in a non-traded alternative can be summarized in brief—a strategy that performs well and is easy to explain to clients. Other top product attributes roughly aligned with their top recommendation drivers. The survey also uncovered an inclination toward investments associated with well-known names and designed to help provide downside protection.

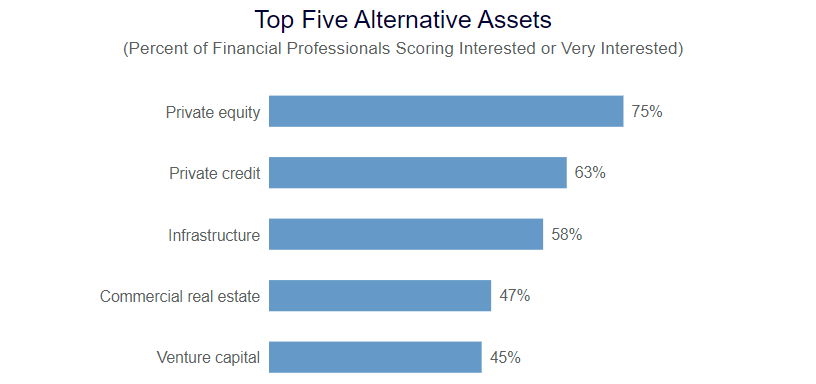

Top Five Alternative Assets

In Recap

Interest in alternative investments has grown in recent CNL surveys. Areas of particular interest include private equity and private credit, especially if investment strategies are easy to explain to clients. That said, non-traded alternatives are not appropriate for all investors. In working with clients to make this assessment, financial professionals should consider a range of factors, including investment time horizon, risk tolerance and suitability. Depending on an investor’s goals, risk tolerance and other factors, alternative investments could help increase a portfolio’s diversification while also offering the potential for growth and/or income outside of traded markets.

About the Survey

In April 2024, CNL emailed the survey to financial professionals in the independent broker-dealer (IBD) and registered investment advisor (RIA) channels. A total of 223 recipients participated in the survey. Aggregate results have a margin of error of 6.56% at the 95% confidence level. The margin of error broadens for questions posed to a subset of survey respondents.

1 Board of Governors of the Federal Reserve System (U.S.), Federal Funds Effective Rate [FEDFUNDS], FRED, Federal Reserve Bank of St. Louis, accessed July 10, 2024.

2 S&P 500 Index, Yahoo! Finance, Yahoo!, accessed July 10, 2024.

3 “First Quarter 2024 Non-Traded Alts Fundraising Up 69% Year-Over-Year,” The DI Wire, April 22, 2024.

4 Financial professionals who rated their likelihood to recommend a non-traded alternative in the next 12 months as seven or higher on a 0-10 scale.

5 Financial professionals who rated their likelihood to recommend a non-traded alternative in the next 12 months as nine or higher on a 0-10 scale.

The information provided only summarizes complicated topics and does not constitute financial, legal, tax, or other professional advice. Further, the information is not all-inclusive and should not be relied upon as such. All charts are sourced to CNL unless otherwise noted.

CSC-0724-3699826-INV